Common misconceptions about peering ecosystem in India

Last week I attended ISOC-Medianama peering roadshow in New Delhi. The core idea for the discussion was about TRAI’s recommendation to bring authorization to IXPs in India.

Somehow during the discussion, the point about incumbents not peering in India kept on coming up. One of the presenters casually commented on how incumbents are not peering in India with smaller networks and thus smaller networks have to buy transit. This is technically incorrect and confuses peering with transit. During the panel discussion things again went in the direction of how the peering ecosystem is failing because incumbents do not peer at the local IXPs. In this post, I am going to explain these misconceptions in detail.

Misconception #1: Small ISPs need transit because large players do not peer

It’s important to first understand the difference between peering and transit. Let’s say we have two networks: A and B. Here’s what happens if A peers with B Vs A buys IP transit from B:

| Peering | IP Transit |

|---|---|

| A can only reach B (and customers of B). B can only reach A and customers A. | A can reach any network in the world via B |

| A would get B’s own routes + customer routes only | A would get B’s own routes + B’s customer routes + B’s peer routes + B’s upstream routes |

I covered this concept long back in Oct 2020 at the INNOG Tech session. Slides 6-11 here cover the difference in detail. By just peering a couple of Indian operators one would not get access to the full routing table and transit would still be needed. The only situation where peering will get access to the full routing table would be to peer with all known transit-free tier 1 networks and all (except Tata Comm) in the list are not present in India let alone the closed peering policies. So the idea of someone serving within a city, state or even a single country would not be practical.

Misconception #2: Indian peering ecosystem is not good because telcos do not peer

Again, this point keeps coming up. It is often suggested that peering is bad because large telcos do not peer with smaller ISPs. In reality, the majority of traffic goes from content to eyeball ISP networks. The majority of content players present in India have an open peering policy & peer with a mix of PNI (Private Network Interconnect) and IX peering. Interestingly majority are peers of large incumbent networks. Thus their routes won’t even be visible to an ISP peer technically even if say Airtel/Jio agree to peer with a small ISP who is expecting content traffic.

I am a supporter of an open peering policy, I prefer to buy my own home, and server connectivity from players with an open peering policy. But with that being said whether incumbent peers openly or not should not impact the peering ecosystem. Pick any large IXP in the world and see if incumbents in those countries are peering openly.

Let’s pick some example IXPs from Terabit club page:

| IXP | Dominant Incumbent | Peering policy of incumbent |

|---|---|---|

| DECIX Frankfurt | Deutsche Telekom | Restrictive (peeringdb) |

| Equinix Singapore | Singtel | Selective (peeringdb) |

| LINX London | British Telecom | Restrictive (peeringdb) |

| France IX | Orange | Restrictive (peeringdb) |

| Namex IXP Italy | Telecom Italia | Restrictive (peeringdb |

I can go on and on here. Whether incumbents have open or restrictive peering policies - the impact of that is on outbound heavy content players and not the eyeball ISPs in the ecosystem. This is specially true for hosting companies, smaller cloud players, VPS providers, datacenters etc.

Decisions to peer or not should be left to free market decsion making. The only situation where it makes sense to force peering should be if ISPs have an exclusive last mile/termination monopoly (like some of the countries in the EU). In India, I guess BSNL at one point had it (much before content peering even came into existence) but for now no one - BSNL, Airtel, Jio, ACT etc has termination monopoly rights in an area (as far as I know).

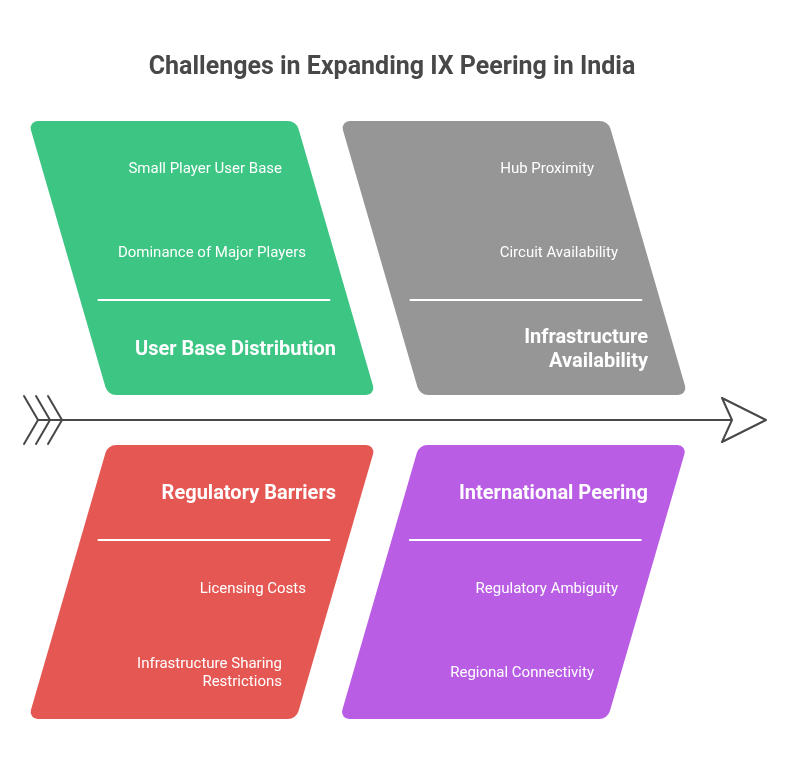

Indian IX peering ecosystem has low traffic (not the peering system outside of IXP) for the scale and size of the country because:

- Low numbers of end users outside of PNI capacity - There are close to 900 million mobile broadband users compared to just 41 million fixed-line users. And even in the fixed-line userbase of 41 million, 27.8% is Jio, 20.7% is Airtel, 10.5% BSNL, and 5.6% ACT and hence these top 4 players carry 67.6% of the broadband market. So what is left is just 32.4% of fixed-line or barely 13.2 million users on smaller players where IX peering would be useful. For the top 4 it’s mostly 100G PNIs with large content networks. It would probably extend to some players in that 32.4% bracket like my ex-employer Spectra, Excitel, Ishaan, Sify, Microscan etc. In the overall scheme of things ISPs serving 13.2 million need IX peering which accounts for just 1.4% of the overall user base (wireless+fixedline).

- Availability of circuits & regulation - More and more options should be encouraged to promote peering. One major roadblock to it is active infra-sharing. Take e.g if an ISP serving me in Haryana is building its dark fibre to Delhi to peer, they can light fibre for their own usage and peer but they cannot run DWDM and sell capacity without an expensive NLD / access license. Govt. should try to design a way to make 10G/100G wavelengths available in a radius of say 500-600Km from existing large peering hubs like Delhi, Mumbai, and Chenna over a mix of NOFN, Railtel, BSNL, Powergrid etc. The rest private sector would immediately put that sort of capacity to use.

- Lack of India international peering hub - Find out who peers at IXPs I put the above list - non-local networks! Take e.g. DECIX Frankfurt where the majority of networks from Asia, the Middle East and Africa peer with content hosted in the EU. We should promote peering of ISPs from Nepal, Bhutan, Sri Lanka, UAE, Singapore (and Bangladesh once it’s stable again) at Indian IXPs. As of now some of it happens, some of it is grey area in Indian regulation, some of it is grey area in those respective countries regulation.

Misconception #3: There is no peering outside of the IXP ecosystem in India

There is a massive amount of peering & caching outside of the IXP ecosystem in India. I often post about the growth of Facebook FNA caches. Last post from May 2024 points out that Facebook FNA caches exist at 79 unique airport codes. The real number city-wise is much higher because many cities do not have airport codes. Take e.g. Airtel. They recently set up BNG in Ambala to serve users from Haryana moving off from the Mohali / Chandigarh tri-city area. Both the Mohali node and Ambala node carry the airport code of IXC (Chandigarh). As of now Airtel + Jio have Google/Facebook caches in almost all state capitals / large cities with BNG, along with quite a lot of Akamai nodes followed by PNIs for peering with large content players. The same is true for players like ACT Broadband. Thus it’s safe to say majority (80%+) of bit delivered in India come from a mix local caches within ISPs as well as their content peerings.

Remember: Someone up the transit path there is always peering!

With hope that you reach one of my CDN edge caches hosted on VMs via peering to read this blog post, time for me to end this post.

Disclaimer: The views expressed on this blog are my own and do not reflect those of my employer.